Each year we look at the most common motorhome insurance claims to help owners stay safer on the road and better understand the risks they face.

From damaged windscreens, to theft, fire and some costly bumps and scrapes, Caravan Guard helped hundreds of customers settle their motorhome insurance claim last season.

We’ve delved into our settled claims from January to December, 2025 to bring you our top five motorhome claims, as well as revealing the costliest claims.

The costliest claim was after a Burstner motorhome worth almost £75,000 was stolen – highlighting the importance of specialist motorhome insurance.

Here are the top five motorhome insurance claim types of 2025, along with prevention tips and how specialist motorhome insurance can help.

-

Window and windscreen damage

Windscreens and windows continued to dominate claims in 2025, making up nearly three‑quarters of all settled motorhome insurance claims. The most expensive windscreen claim cost just over £7,000!

Many were caused by stones thrown up from the road, while others involved impacts from birds, debris and tree branches. One policyholder even reported a smashed windscreen after a large bird strike on a motorway in France!

How to reduce the risk

- Leave extra space behind other vehicles

- Regularly check your motorhome windscreen and repair windscreen chips early before they spread and need replacing

-

Accidental damage

Accidental damage remained the second-biggest motorhome insurance claim type, with a mix of low‑speed bumps, reversing mishaps, campsite scrapes, and collisions involving another vehicles.

Accidental damage accounted for just over a fifth of all our settled claims. The costliest was when a motorhomer collided with another vehicle on a roundabout, with the payout for this claim exceeding £23,000!

Collisions with deer were also costly claims, with one causing more than £20,000 of damage. Other cases included:

- A vehicle rolling into a wall after the handbrake wasn’t applied

- A motorhome driving down a busy road and clipped a car, causing £18,000 of damage

- Damage from overhanging branches and tree stumps

- Impacts with bollards, posts, barriers, lampposts, and even a cement mixer!

- Motorhomes taken down narrow sat‑nav routes, resulting in scrapes and reversing damage

Once again reversing and manoeuvring were common causes of motorhome damage, with many accidents involving gates, posts, bollards, walls, and parked vehicles.

How to reduce accidental damage to your motorhome

- Fit rear‑view cameras and parking sensors

- Take extra care on narrow lanes and campsites

- Use a second pair of eyes when reversing, especially when manoeuvring onto pitches or driveways which could have walls, trees or low hanging branches to avoid

- Double‑check your handbrake every time you park

- Plan motorhome‑friendly routes and use a motorhome-specific sat nav

These common motorhome insurance claims highlight the importance of drivers checking their surroundings, particularly when reversing into a tight spot, pulling in and out of parking spaces, pitching up, and driving down narrow roads or streets.

“Knowing your motorhome’s height and width dimensions is important and having a motorhome specific sat nav should help to avoid unsuitable routes,” said Caravan Guard’s Claims Liaison Manager Steph Bentley. “Also taking care when parking up at home, in storage or in car parks. “

-

Theft-related claims

Although motorhome theft claims were small in terms of frequency, they were high in cost. Around half of theft‑related claims involved the theft of the motorhome itself, often from driveways, storage sites and car parks. Some thieves even broke into homes to obtain the motorhome keys.

Theft of equipment included:

- Leisure batteries

- Driving seats

- Keys

- Air‑conditioning units

- Bike racks

And even attempted thefts regularly caused thousands of pounds worth of damage.

How to prevent motorhome theft

- Fit a visible motorhome steering wheel lock and other physical security devices, like wheel and door locks

- Keep keys out of sight and in a signal‑blocking pouch or locked cabinet

- Fit a proactive tracking device and keep subscriptions up to date

- Add motion lighting and a driveway security post or store behind locked gates

- Choose secure storage with good perimeter controls

-

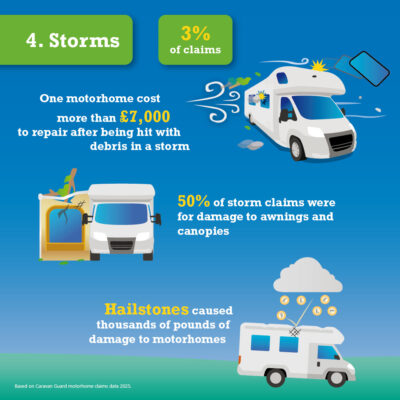

Storm and weather damage

Windy weather continued to trouble motorhome owners in 2025. Awnings and canopies were the most vulnerable, making up around half of all storm‑related claims, with high winds causing awnings to flip over motorhomes, causing roof and sidewall damage, and sometimes damage to nearby caravans or motorhomes.

Although only three percent of settled claims were for storm damage, they can be costly, with the biggest payout being £7,480 after debris hit a motorhome during a storm.

Other weather‑related claims included:

- Skylights ripped off in high winds

- Damage from falling branches

- Hailstone damage costing several thousand pounds

How to reduce the risk of motorhome storm damage

- Take awnings down and retract canopies at the first sign of stormy, windy weather

- Park away from trees during storms

- Check skylight fixings and seals

- Keep an eye on weather alerts when touring

Good to know: Caravan Guard’s motorhome insurance provides cover for storm and awning damage as standard.

-

Other notable motorhome insurance claims

Though less common, some motorhome insurance claims carried high average costs:

Fire damage

Fire remains one of the most serious risks, with the costliest 2025 fire claim reaching over £60,000.

Tyre blowouts and wheel detachments

A handful of tyre blowouts and one wheel detachment resulted in damage, with the most expensive repair approaching £10,000.

Vandalism

Examples included paint damage and deliberate scratching to doors and side panels.

What these 2025 settled motorhome insurance claims tell us…

- Everyday bumps account for a big chunk of motorhome insurance claims, but are generally affordable to repair

- Theft and fire remain the most expensive risks, often causing tens of thousands in losses

- Awnings are very vulnerable in storms and high winds

- Many accidental damage incidents are avoidable with good planning, awareness and preventative measures

Why specialist motorhome insurance matters

Caravan Guard’s motorhome and campervan insurance is designed specifically to cover motorhomes and campervans and includes:

- Accidental damage cover

- Storm and awning damage cover

- Glass and windscreen cover

- £5,000 equipment and personal possessions cover

- Discounts for reversing aids to help prevent damage

- UK roadside breakdown assistance as standard

- Discounts for approved security devices to prevent theft

- European cover option

- UK‑based, highly rated claims service

All benefits are subject to terms, conditions and underwriting criteria. Check our documents page to see our policy wording.

Trust us to insure your freedom and get a quote today: www.caravanguard.co.uk/motorhome-insurance

Have you ever made a motorhome insurance claim? Share your story in the comment box below.

How would you rate this article?

Comments