From storm‑battered awnings to reversing mishaps and pothole damage, 2025 delivered another busy year of caravan insurance claims for Caravan Guard.

We’ve analysed our settled claims from last year to uncover the biggest risks caravan owners faced, and how you can avoid becoming part of next year’s statistics.

In 2025, the costliest claim exceeded £49,000 after a tourer was stolen from a holiday park!

In 2025, the majority of claims were reported from April to August with 14% of caravan claims happening in May for all manner of things like, accidental damage, theft, fire and even storm damage.

Here’s what caravanners claimed for most last year…

-

Accidental damage

Almost half of all settled caravan insurance claims in 2025 (48%) were due to accidental damage, making it easily the most common claim type.

Many were the result of low‑speed manoeuvring or everyday mishaps, including:

- Reversing into walls, trees, hedges, gates, posts or bollards

- Scraping against branches on narrow roads

- Misjudging campsite entrances or tight corners

- Collisions when reversing or hitching up

- Forgetting to retract corner steadies before towing

- Caravans rolling off due to motor movers not being engaged properly

- Impacts from wildlife, including several pheasant strikes!

Some accidents led to high repair costs, including incidents where caravans rolled into houses. The costliest was when a work vehicle reversed into a caravan, resulting in a payout of £ 33,000 for this claim.

Accidental caravan damage prevention

Using a motor mover can help to prevent accidents and damage when manoeuvring, particularly into tight spaces.

“Fitting a caravan reversing camera or asking someone to watch your back when reversing will help spot those hazards,” said Caravan Guard’s Claims Liaison Manager Steph Bentley. “Walking tricky routes on campsites or even at home before manoeuvring can also help.”

We settled several caravan insurance claims after caravanners had not wound up all their corner steadies before setting off, so it’s worth double checking those as well as making sure doors, skylights and lockers are closed before towing.

Take extra care on narrow rural roads and farm lanes – using a caravan-specific sat nav will help to avoid those routes that aren’t suitable for a car and caravan.

-

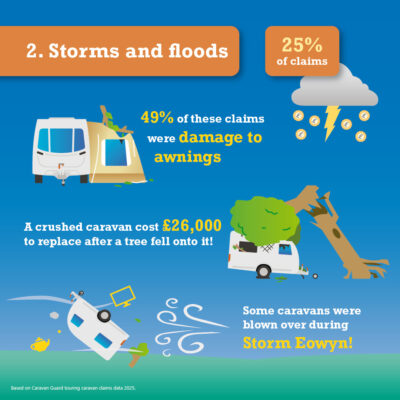

Storm damage

Stormy weather played a major role in 2025 caravan insurance claims. One in four caravan insurance claims were linked to storms, high winds and flooding.

Nearly half of all storm claims involved caravan awnings, many of which blew over caravans or were ripped from their fixings – highlighting the importance of making sure your caravan insurance policy includes storm cover for awnings and that your awning value is included in your sums insured. The average cost of damage claims to awnings caused by stormy weather was £1,210!

Several caravans were blown onto their sides in severe winds, and January was particularly stormy, with almost a third of all storm claims occurring during that month when Storm Eowyn hit the UK.

The costliest claims were in January after a tree fell onto the corner of one caravan and a tree branch fell onto another. Both payouts were for just over £26,000!

Storm prevention tips

- Take down awnings in strong winds or when leaving the caravan unattended for long periods

- Avoid pitching under trees where branches could fall

- Check storm warnings when on holiday

See our video on how to set up your caravan awning for maximum strength.

-

Towing accidents

Caravanning accidents on the road accounted for roughly one in ten caravan claims in 2025, but they tend to be more expensive than accidental damage incidents on site or in storage, with the most serious incidents leading to five figure repair totals!

Nearly half of these road accident claims were for detachments, with the most expensive payout for a detachment claim just over £15,000!

Roughly one in four caravan road accident claims were tyre-related, including blowouts, and one in five were for pothole damage, causing some significant damage to caravan axles, motor movers, underbodies, and even cracking the bodywork!

Other road accident claims included wheels coming off caravans and jack-knifing incidents.

Caravanning road accident prevention

- Make a PACT for tyre and wheel safety by checking tyres for pressure, age, and cracks and making sure wheels are torqued correctly

Make sure hitches, stabilisers and safety cables are correctly connected and always perform the wind back test to make sure your caravan is correctly hitched up

Make sure hitches, stabilisers and safety cables are correctly connected and always perform the wind back test to make sure your caravan is correctly hitched up

- Avoid overloading the caravan

- Slow down on poor road surfaces or unfamiliar routes

A tyre pressure monitoring system will also monitor tyre pressures and temperatures whilst towing, and Tyron safety bands can reduce damage in the event of a blowout. We offer an insurance discount for fitting these tyre safety devices.

-

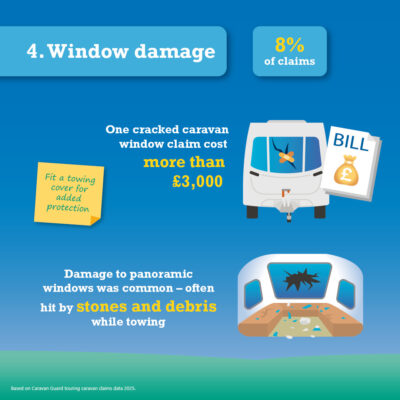

Window damage

The fourth most common caravan insurance claim was for window damage, making up eight per cent of settled claims, with the highest caravan window claim exceeding £3,000 for damage to a panoramic window.

Window claims were mostly caused by debris hitting the caravan while towing, with front and panoramic windows being the most common victims.

Caravan window damage prevention tips

- Keep a safe distance from vehicles in front when towing

- Consider a towing cover for added protection

- Avoid following construction vehicles or lorries too closely

- Slow down on newly laid roads or bumpy surfaces

-

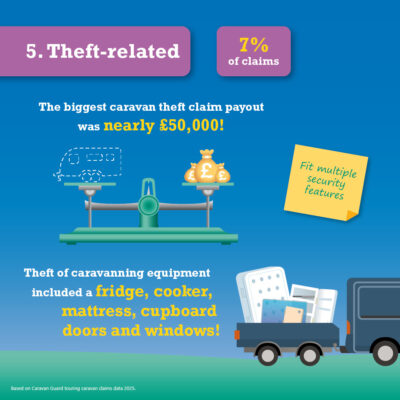

Caravan theft and theft-related claims

Although a smaller share of overall caravan insurance claims, theft‑related claims caused some of the highest losses of 2025.

Around half of all theft claims involved the theft of the caravan, and the highest-value theft claim of 2025 was nearly £50,000 after a caravan was stolen from a holiday park!

Caravans were also stolen from driveways and storage sites, highlighting the importance of making sure your pride and joy is kept in a secure storage site, which has controlled access gates that are locked 24 hours a day, high perimeter fencing, as well as CCTV, and that it’s regularly monitored by security staff.

Thieves also targeted equipment, including gas bottles, cushions and mattresses, windows and doors, TVs and even a cooker!

Even attempted thefts resulted in costly damage to doors, locks and panels.

Caravan theft protection

- Fit multiple caravan security features (e.g. hitchlocks, wheel clamps, security posts)

- Use an alarm and tracking device for added protection

- Store the caravan in a secure, reputable site when possible or behind locked gates at home

- Keep valuable equipment out of sight

Caravan Guard offers caravan insurance savings for safety‑ and security‑conscious owners, including those who fit approved security devices.

See our caravan security guide.

Other caravan insurance claims in 2025

Although smaller in volume, we also settled caravan insurance claims for:

- Escape of water from a burst tap

- Vandalism after stones were thrown at a caravan in storage

- Fire damage from neighbouring caravans in storage

These incidents highlight the importance of having specialist caravan insurance that covers a wide range of scenarios, not just the big ones.

Why specialist caravan insurance matters

Caravans are vulnerable to weather, storage incidents, towing mishaps and theft. With Caravan Guard’s specialist and award-winning caravan insurance, owners can benefit from:

- Storm and awning damage cover

- Accidental damage cover, in storage, on the road and on-site

- Theft cover

- Repair or replacement for windows, skylights and panoramic panels

- Equipment and personal possessions cover

- Savings for fitting security devices

- UK‑based, highly rated claims service

All benefits are subject to terms, conditions and underwriting criteria. Check our documents page to see our policy wording.

So why not trust us to insure your freedom and find out more about our Trustpilot five-star rated caravan insurance cover here.

How would you rate this article?

Comments